SJNY Magazine

- Faculty NewsFeaturedLong Island

Innocence Project Speaker Details His Fight for Freedom

by Brian Harmon April 11, 2024In a poignant and gripping presentation at St. Joseph’s University, New York’s Long Island Campus, Carlos Sanchez shared his harrowing journey of what he maintains was a wrongful murder conviction,…

“Speed doesn’t matter. Forward is Forward.” That’s what SJNY Online‘s Tracie Esposito’s graduation cap is going to say on it this May as she crosses the stage at commencement —…

- Faculty NewsLong Island

Federal Court Pretrial Officer Shares Expertise with Criminal Justice Students

by Brian Harmon March 25, 2024A U.S. Pretrial Services Agency officer spoke with dozens of criminal justice majors this semester during a presentation in the Long Island Campus’ Shea Conference Center. Mallori Brady, who works…

- Alumni NewsBrooklynFeaturedLong IslandOnline

Stephen Somers ’82 Honors Legacy with $1M Scholarship Gift

by Valerie Esposito March 19, 2024Driven by his passion to make a positive impact in the lives of others and to give back to an institution that he credits with transforming his life, alumnus Stephen…

- Faculty NewsLong Island

Championing Critical Thinking: Dr. Eunah Lee’s Passion for Philosophy

by Sam Miller March 12, 2024Eunah Lee, Ph.D., first became interested in philosophy during high school. She found herself mesmerized while reading Korean-translated excerpts from German-American philosopher Herbert Marcuse in her literature class. Now, Dr.…

- Faculty NewsLong Island

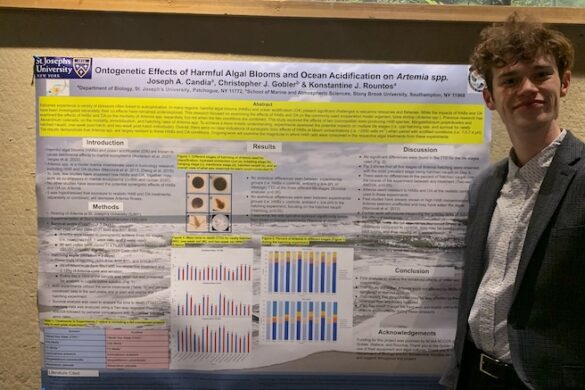

Biology Education Student Presents Thesis Research at Prestigious Conference

by Valerie Esposito March 6, 2024SJNY senior Joe Candia ’24 has taken advantage of the many opportunities provided to St. Joseph’s students for hands-on learning. After spending last summer as a research student with Konstantine…

Corned beef and cabbage, bagpipes, and lots and lots of green. St. Joseph’s University, New York alumni gathered Sunday, March 3, at the Dyker Beach Golf Course in Brooklyn for…

- Alumni NewsLong Island

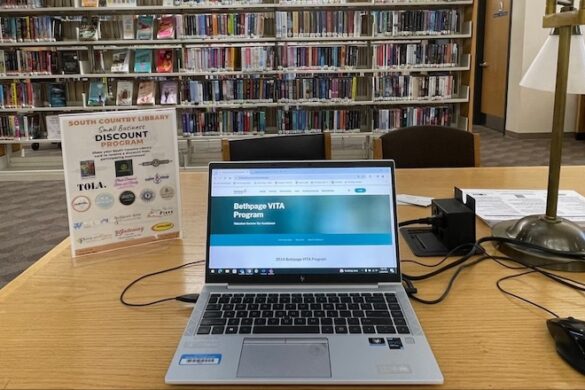

SJNY Accounting Students Providing Tax Return Help in Bellport

by Brian Harmon March 6, 2024Student volunteers from St. Joseph’s University, New York are participating in a community outreach effort that is providing free income tax preparation services for low and moderately income residents of…

- Alumni NewsBrooklynI Heart SJC Week

Building a Bond Beyond the Court: Billy ’06 and Kristin Haufmann ’06

by Brian Harmon February 14, 2024From their high school days at Christ the King in Queens to their college years at St. Joseph’s University, New York’s Brooklyn Campus, William “Billy” Haufmann and his wife Kristin…